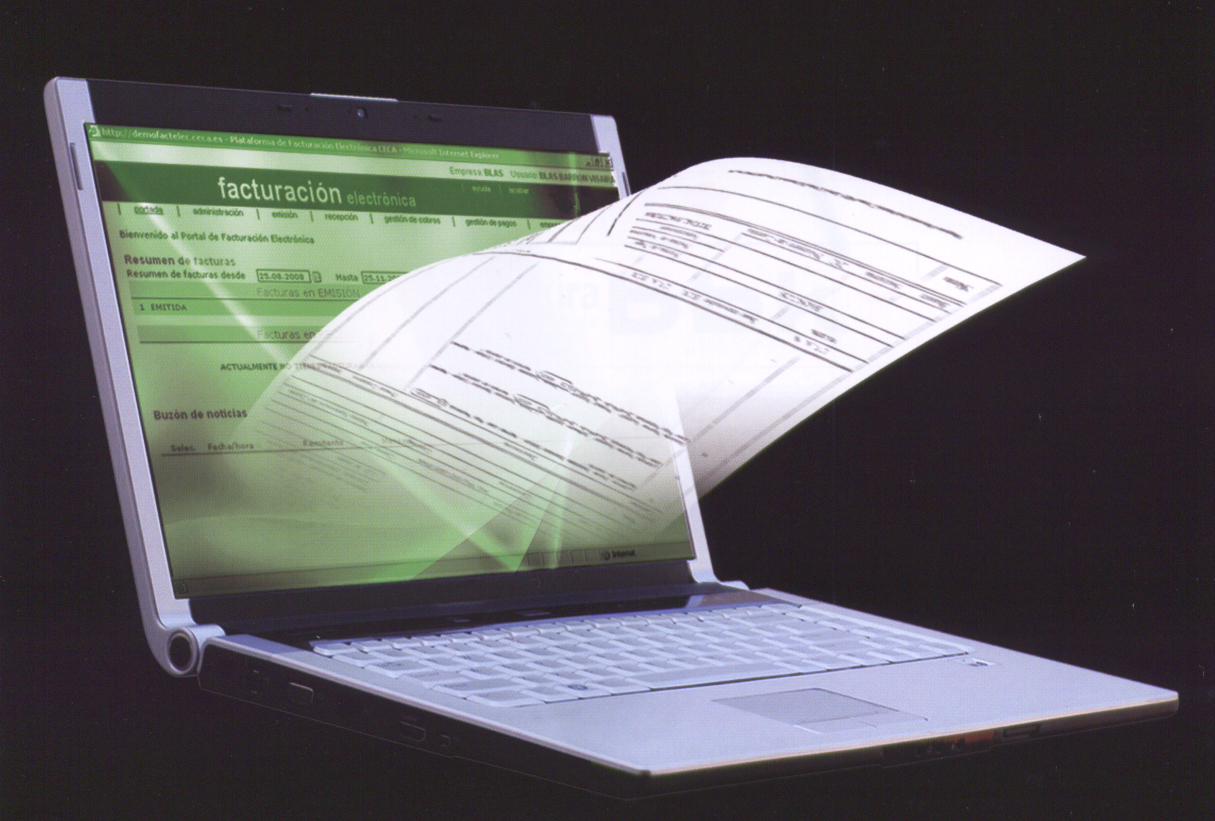

At the beginning of this year the Electronic bill it is already mandatory for large firms and small companies. And, despite its proven benefits, this billing model still does not have a massive presence, especially among SMEs.

Added to this is the enormous ignorance that entrepreneurs have about what electronic invoicing is, the different formats or the systems to integrate it into their organization, as the general director of the Foundation for the Infotechnological Development of Companies and Society warns.

Some questions that we will solve throughout this report with the help of various experts in the field. And all this with a single objective: to say goodbye to paper.

Delegate or not to third parties

As a first step, it is necessary to know what the process consists of, which is summarized in the transmission of invoices or similar documents by electronic means (computer files) and telematics (from one PC to another); These will be signed digitally with qualified certificates, with the same legal validity as paper invoices.

Afterwards, you will have to make the decision of whether to take care of this task yourself or delegate it to third parties. If you choose the former, Arbaiza sends the message of its simplicity. “Almost all management and accounting programs have an electronic invoicing module. The only procedure here would be to get a certificate to sign ”, he assures.

In addition, private and public entities are launching initiatives aimed at facilitating the use of electronic invoicing. Specifically, the KIUBIX electronic invoicing It offers the facility that they carry out all the corresponding procedures and you will only worry about the realization of the invoices.

Invoice yourself

If one assumes electronic invoicing internally -without outsourcing it-, several formulas are available to them which, depending on their degree of complexity, are:

- The simplest. Sign an email (or a document in Word, Excel, Acrobat format) and send it with the invoice data. This modality is not the most common or the most beneficial, according to the experts consulted. "It is evident that if the receiver has to retype the data that arrives in a PDF, the efficiency and speed that the system is supposed to do will disappear", Inza illustrates.

- Intermediate formula. It consists of issuing or receiving invoices from a website with applications that allow you to create them manually. Sebastián Muriel, general director of Red.es, points out that it is an affordable method, designed for those who are afraid of a more complex alternative. It is also interesting for small SMEs, with a small volume of invoices, says Xavier Puyol, Head of Implementation and EDI Projects of the Spanish Association of Commercial Coding (Aecoc).

- The most complex (and complete). It is about integrating a specific billing module in the management and financial systems of the company. Experts agree that it is the ideal formula and with which the advantages attributed to electronic invoicing are obtained. Among them, greater agility in the procedures, since the processes are automated.

Leave it in the hands of others

For entrepreneurs who opt for the formula of delegating billing, there are collective tools promoted by banks, telecommunications operators or IT management companies, according to Pérez. But you also have to bear in mind that this method does not exempt you from the legal responsibilities that any invoice entails, so you would have to be very careful when choosing the provider. Solutions vary, depending on whether the process is fully or partially outsourced:

- Maximum comfort. In this case, the entrepreneur does not have to worry about anything, as the platform will be in charge of meeting all operational, legal and other requirements. These systems have a connection so that the user can enter their invoices. From that moment on, a specific document format will be generated to which an electronic signature will be applied.

- A signature, please. On this occasion, the provider only has to provide the signature, although it is also possible to offer other complementary services, such as its validation.

There are no two without three

Apart from these two outsourcing formulas, there is what is known as self-billing. In this option, the person responsible for preparing the invoice is the receiving entity, which, normally, also signs it. This type of operation is common in some very specific sectors, such as insurance. In this way, the insurance company generates the invoice, after the professional whom it has hired to solve a claim has sent it the data of the work carried out

No Comment