Goodbye to cash in Mexico?

In this post we solve the most common doubts about Digital Collection (CoDi), the mobile payment platform that is fully supported by Banco de México.

BACKGROUND

Since April, the launch of the pilot program to launch the CoDi, which is a system developed by Banxico and endorsed by the banks, that allows remote financial transactions through the scanning of codes between smartphones.

What do you need?

Just a smart phone and a bank account. We share the following data (via Coru):

Considering that many banks in Mexico offer savings accounts free of commissions, in addition to payroll accounts, and that the 75% of Mexicans has a cell phone, according to the latest National Survey on Availability and Use of Information Technologies conducted by the National Institute of Statistics and Geography (INEGI), it will be easier for people to access this tool.

That's how it works

The mechanism works both to collect and to pay for goods and services by reading Quick Response (QR) codes, through an application that is downloaded to smart cell phones. Thus, thanks to QR scanning, transactions can be made immediately without using cash or bank cards.

The CoDi is an extension of the SPEI (Interbank Electronic Payment System), but it promises to be of immediate execution and it will be possible to use it 24/7.

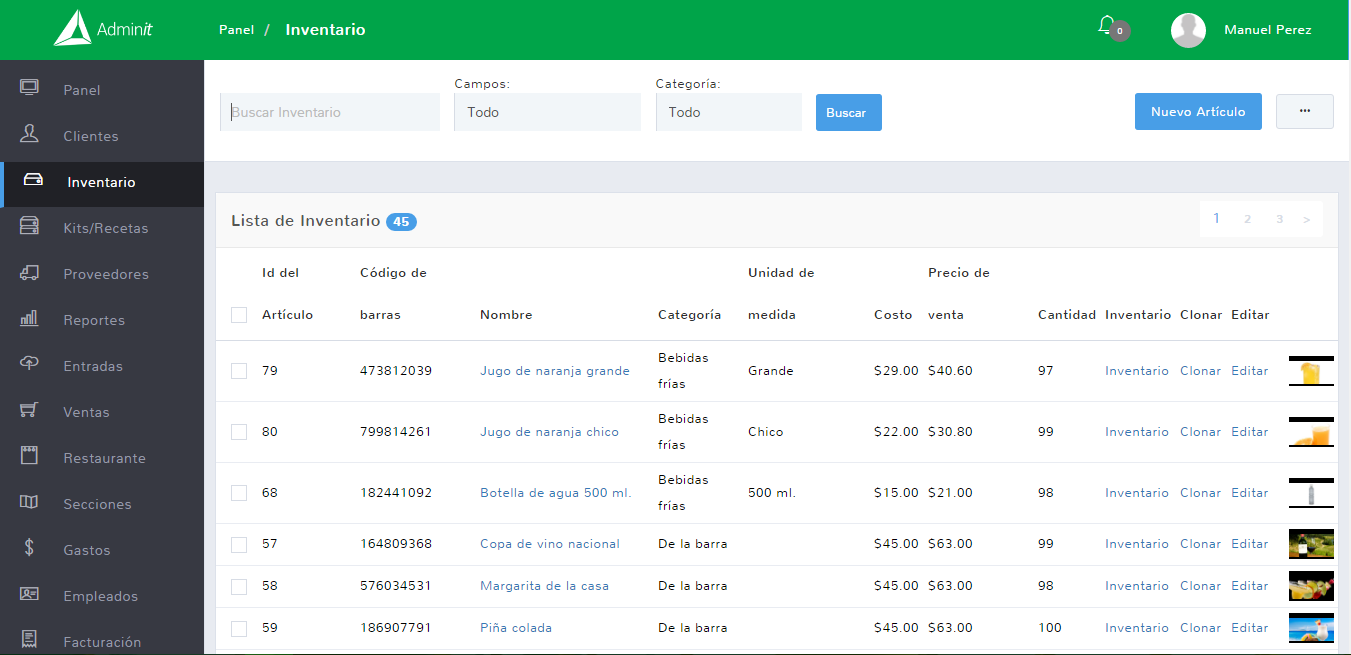

All businesses that carry out over-the-counter sales such as shops and stores, e-commerce operations and service providers can implement the payment method through cell phones or mobile devices. They only have to register in Banxico, in the section "Requirements to participate in CoDi".

Do you have commissions?

Using this payment and collection system will be free of commissions for both the client and the business. The limit of the transactions will be 8 thousand pesos. Along with this, the user will receive a notification that their money has reached the account of the establishment and the merchant in turn a notice that the payment is made.

General recommendations

- Since the process consists of information exchange through cell phones, it is advisable to have a medium / high-end equipment and an internet connection.

- If you do not have a bank account, some financial entities will make available to users an express process of opening accounts from the mobile phone, without the need to have an associated card, in order to have a QR code to make collections and receive payments . Only one QR code should be generated per person, regardless of the receiving bank.

How does a merchant integrate it into their business?

The payment process begins with the QR code. You should leave it in a visible place in your business so that the client can see it easily. The buyer will open the application on their smartphone, choose the option to pay, enter the amount, then scan the QR code that you placed, confirm the payment and you will have your payment made.

Risks and benefits

For the buyer it means an immediate payment from their smartphone, which prevents them from leaving home with cash and even bank cards. In addition, no one has access to your account, nor does the client need the data of the one in which they will deposit.

For the employer, it is a way of receiving payments at a higher speed than the current SPEI, without commissions in amounts of up to 8 thousand pesos and guaranteeing greater transparency in the origin of the income.

Since the QR of the establishments will be unique, the customer will see the name of the business once the payment is approved and will have a confirmation message to avoid risks such as a double charge.

Regarding shielding, it has been thought of using the fingerprint as an extra security measure, in case of theft of the phone and unlocking of the password of your application.

No Comment