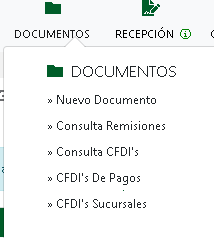

1.- We enter the upper menu DOCUMENTS - NEW DOCUMENT

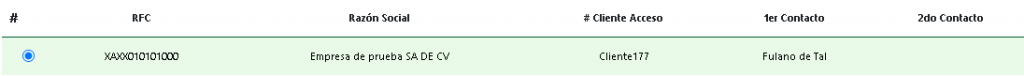

2.- We look for the client and select him in the red circle next to his name

3.- This will enable the options in TOOLS (if we do not select the client, they do not appear)

4.- We click on INVOICE

5.- Tools:

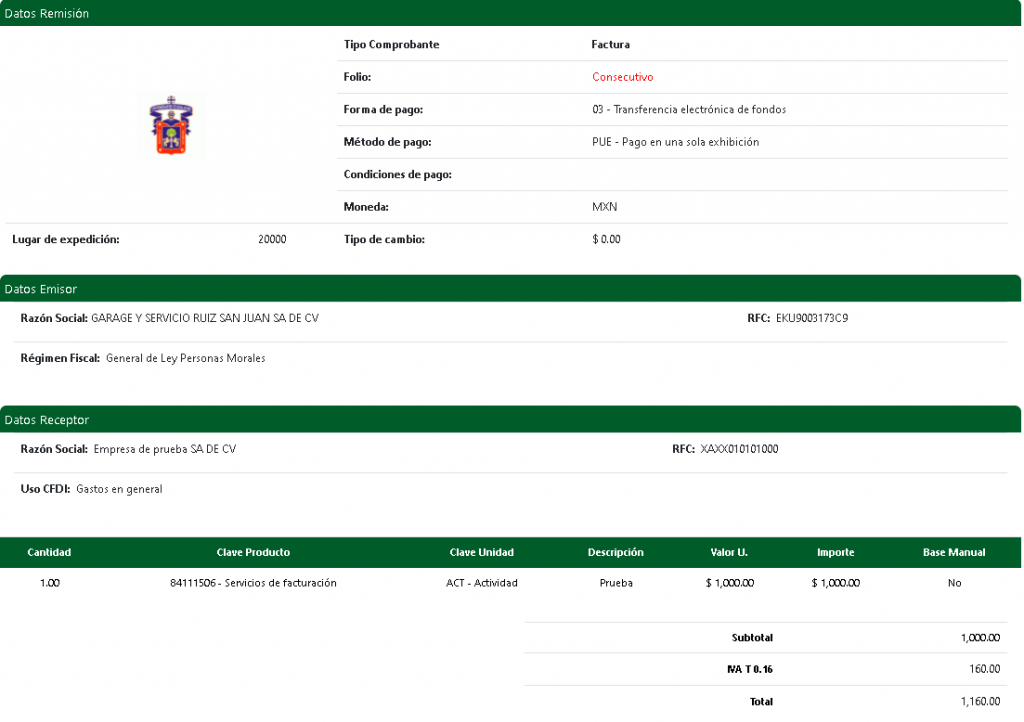

Preview Document: converts the invoice into "Remission", that is, a draft that is automatically saved in the system.

Tax Regime: Regime change that we have registered in the system.

Add related CFDI: We can add a related CFDI, this applies to payments, credit notes and the documents indicated by the SAT.

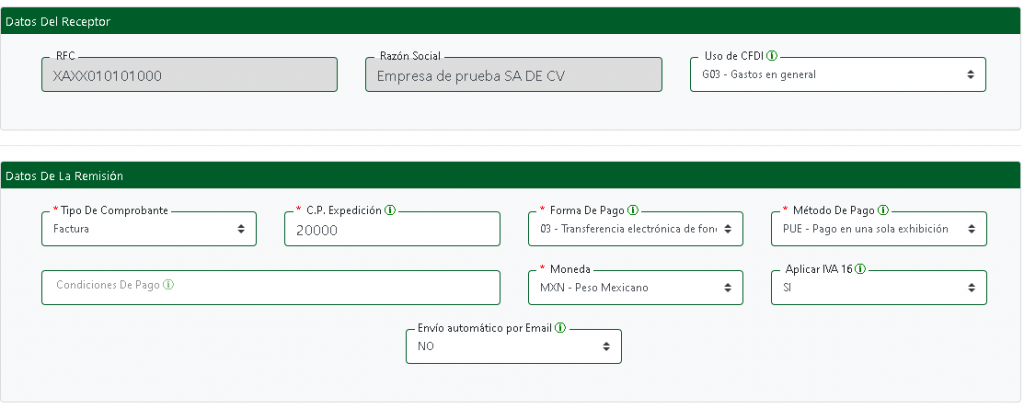

6.-We fill in the invoice data as appropriate, we must confirm our CP

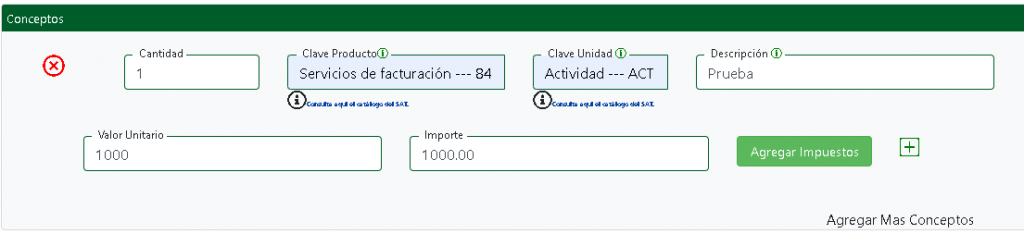

7.- We fill in the data of the product or service.

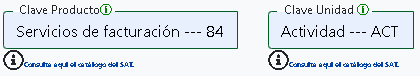

8.- If we do not remember the Product or unit codes, we can enter the links below these boxes.

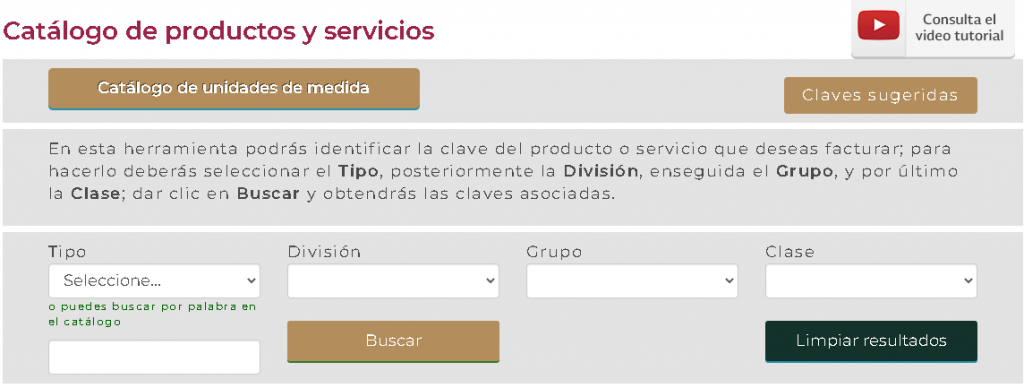

9.- The link takes us to the SAT page where we can search for our product and / or service.

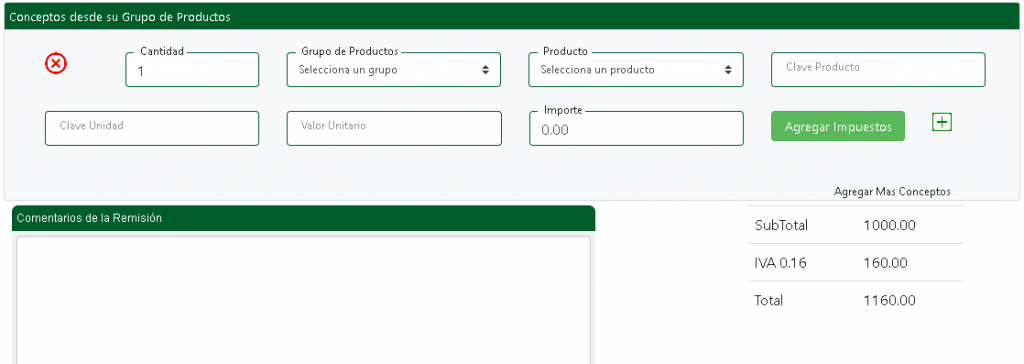

10.- The amounts and taxes will be added at the bottom of the screen

11.- First click on PREVIEW at the end of the page.

12.-It will show us a screen with the invoice data.

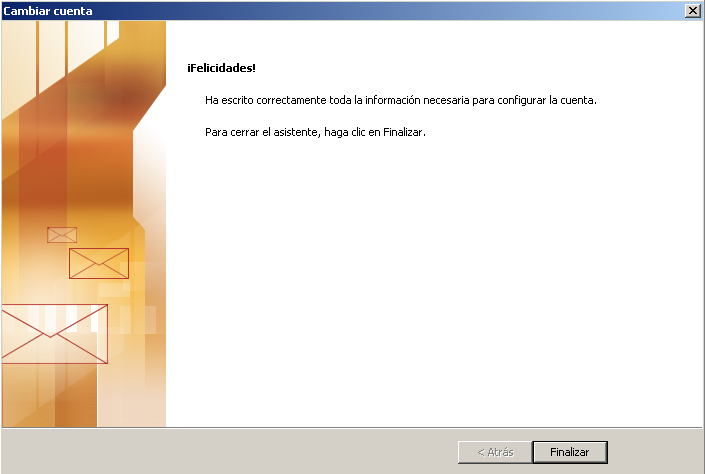

13.- Once we confirm the data we can click on GENERATE CFDI in the upper section of TOOLS.

No Comment