METHOD “A” ADVANCE INVOICE WITH CREDIT NOTE

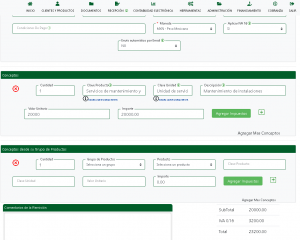

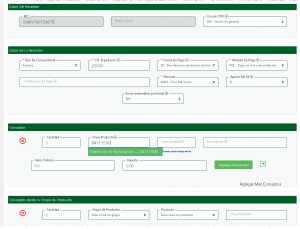

1.-We enter DOCUMENTS - NEW DOCUMENT

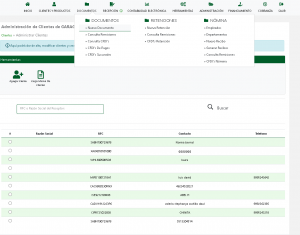

2.-We select the client to enable the documents that we can make and click on INVOICE

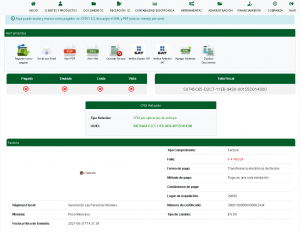

3.-We add the payment data, method, payment in a single display

4.-In SAT code we use 84111506, ACT Unit

Concept or description: ADVANCE OF THE GOOD OR SERVICE

And the unit value of the payment

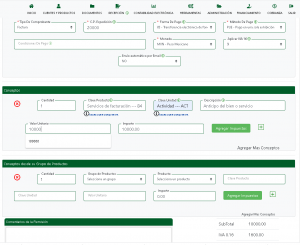

5.-We click on preview to convert it into a "referral"

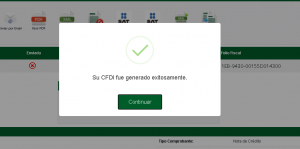

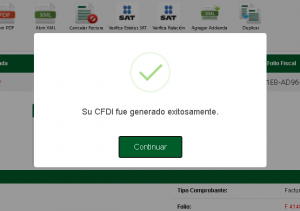

6.-Later, once the data has been confirmed, we click on GENERATE CFDI

7.-And we will open a confirmation message.

This is an advance payment, of which we still do not know the total amount or the service to be billed.

Once the invoice has been settled and we know the service and / or final amount, we proceed to make the invoice with the full payment.

STEP 2.- Invoice for the full service

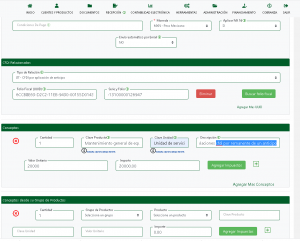

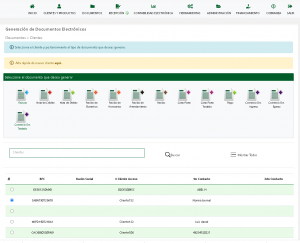

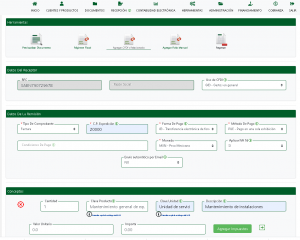

1.-We enter DOCUMENTS - NEW DOCUMENT again

2.-We select the client to whom we made the first invoice and click on INVOICE again

3.-We enter the data of the product, which is already known the description and amounts.

4.-We click on the top menu button ADD RELATED DOCUMENTS

5.-It will open a section to associate the previous document

We select option 07 CFDI By application of advance

Remember to have your previous invoice or at least the folio at hand, we must enter them in SERIES AND FOLIO separated by a hyphen eg. F-15.

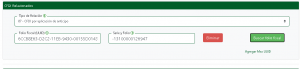

6.-Later we click on SEARCH FISCAL FOLIO, so that we associate the invoice that we already have

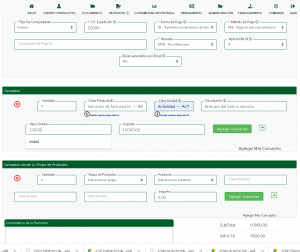

7.-We click on PREVIEW DOCUMENT and we can access the referrals (drafts)

8.- We click on GENERATE CFDI and the invoice will be created.

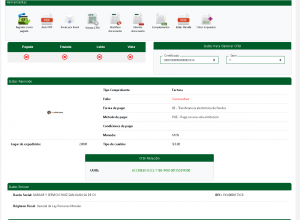

STEP 3 Generate credit note

Up to this point it is as if we had doubled balances, having an invoice for the total and another for the advance, now we have to withdraw the balance of the advance to kill this duplication.

We do this with an outgoing invoice (credit note).

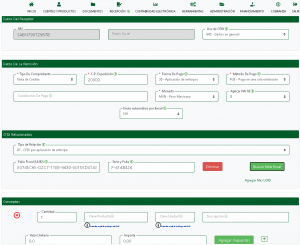

1.-We enter DOCUMENTS - NEW DOCUMENT again, select the client and click on CREDIT NOTE.

2.-We fill in the invoice data

Payment method 30 application of advances. We relate the invoice from step 2 with its series and folio

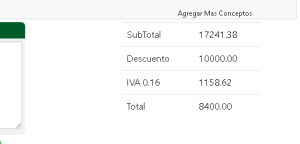

3.-The amount must be the same as the advance, click on preview and wait for it to load

4.-We click on GENERATE CFDI and we already have our credit note made

With these steps we have liquidated the movement.

Indications taken from the use case, SAT advance application http://omawww.sat.gob.mx/tramitesyservicios/Paginas/documentos/Caso_uso_Anticipo.pdf

Note: However, as described, you can also choose to apply the procedure "B Billing applying advance payment with the remainder of the consideration" which you can consult in Appendix 6 cited above at the following electronic address:

http://omawww.sat.gob.mx/tramitesyservicios/Paginas/documentos/GuiaAnexo20.pdf

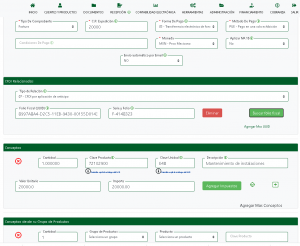

METHOD B billing applying advance payment with the remainder of the consideration.

1.-We enter DOCUMENTS and select the client and click on INVOICE. Once inside the process it is equal to a normal invoice, we enter the data of the product or service

2.-We add the related documents by clicking on the top menu ADD RELATED CFDI

3.-The Related CFDI section will open, where we have to integrate the folio and series to find the invoice previously made in the system.

Type of relationship 07 CFDI by application of advance

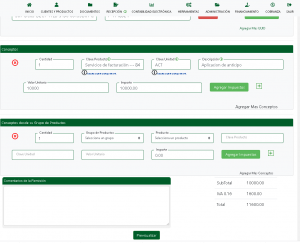

4.-At the end of the product description you have to add the legend "CFDI for the remainder of an advance”.

5.-We have to add a discount to kill the balance of the advance invoice, we do this in CONCEPTS in the "+" sign to be able to add one, we can select by percentage or amount, this must be for the amount of the invoice in advance without considering VAT.

6.-The total payment of the invoice, must correspond to the missing amount for the settlement of the invoice

7.-We click on PREVIEW and we can identify that the advance document is already related and our amount corresponds to the payment that settles the movement.

8.-We generate the CFDI to finish the process.

Note: With this it is not necessary to generate a credit note since we do not duplicate balances.

Both forms are valid and are published in annex 20 appendix 6 of the guide for filling out tax documents.

No Comment