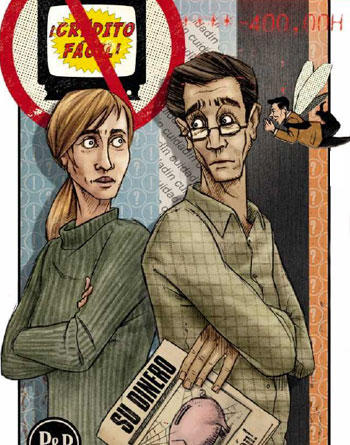

We introduce you to Pepe de Sastre and Pepa Cala Midad. They are a happy couple with two children: Paquito, the eldest, has turned eight, and Currita, the youngest, six. His life is going normally in almost all respects. Except for one thing, they are an absolute disaster when it comes to money. They both work and have good salaries. But they are unable to put their accounts in order and, above all, they are unable to control expenses and, in the end, live more comfortably.

'Keep in mind

With the disasters they are, we do not trust Pepe and Pepa to put themselves in the hands of an expert to help them balance their accounts. Therefore, we have done it for them. And, to make it easier for you, we have prepared a decalogue for you, a top ten of what you should do and, above all, what not to do on a day-to-day basis with your money.

Don't trust Pérez. Neither of the mermaids. Often, when making a decision that has to do with our money, we tend to get carried away by Pérez. Pérez can be anyone: your office partner; the neighbor of the fifth, whose son works in a savings bank, or the bank branch manager himself who, pressured to place this or that fund, has no qualms about trying to sneak it in.

Well no. Do not listen to whom you should not: only the real professionals. And do not make the investment decisions alone or get carried away by siren songs of values that soar on the stock market in the heat of who knows what reasons and that are nothing other than sucker-catchers.

Don't have what you don't need. “Most of us have multiple accounts, which sometimes we don't even look at, and a bunch of cards, which we don't really need. You even have credits that you could perfectly be saving. All this is expenses, many euros a year in commissions. And, above all, a lack of control that prevents you from being aware of the charges and keeping your accounts to the letter ”, says José Antonio Almoguera, CEO of the consulting firm Megaconsulting.

Do not remain a debtor. Often times, what causes you to have many accounts and many cards is that, in the lack of control, you have to zero the one in which you are going to be charged. And that makes you stay in the red, which is the best deal for a bank because they immediately apply much higher interest to you. “If you remain a debtor with the card, the joke can cost you a 20% or a 30%. And if you keep the mortgage, they can take an eye out of your face, ”says Almoguera.

Beware of commissions. Banks charge you for everything, even for the letter they send you to inform you of the movements of your account or of this or that charge or income. That is why you receive so many letters from your bank, not for anything else. It is in your hands to prevent the bank from living on your commissions. And, if you can't help it, reduce it. Choose those entities that charge less or do not charge, reduce your accounts and cards and, above all, claim those that seem unfair or abusive to you. Complaining with the threat of going to another bank works.

Don't confuse the months with the years. It is not a truism. Often, financial entities camouflage the annual interest in the monthly y and tell you that they charge you 1,15% when in reality they are charging you 14,71%. That is, 1,15% is the monthly rate, but what you should look at is the APR, the Annual Equivalent Rate that, as its name suggests, is annual and is equivalent to 14,71%.

This happens especially with credit cards, when splitting the payment. For example, 100 euros per month. It is what many banks call the flat rate: every month you pay 100 euros, although in reality, you amortize 97.2 euros and the other 2.68 euros are interest: 1,15%, which is, effectively, 14,71% per year.

Beware of credits

Many instant credit institutions use the lure of immediacy. From the «Call now!« To that of «In less than 48 hours you will have the money in your account! ». That, to begin with, is almost never like that, not that easy and not that fast.

Don't be in a hurry. “If you do things calmly and do not get carried away by the ads, you will save a lot of money because in your bank you can get the same money at an interest rate of 8%. While the fast credit company will charge you a 24%. If not more ”, says Manuel Pardos, president of Adicae. Check the bill backwards. The claim of companies that are dedicated to the reunification of debts is that you can reduce by half what you pay per month for your credits and loans. That is only a half truth, because in the end, you will pay much more because as you extend the life of your debts, the interests skyrocket.

Don't take a mortgage on a car. Reunifying debts means putting everything you have bought on credit under the umbrella of your home. That is to say: include in the mortgage the credit of the car, that of the plasma TV and what you bought with the credit card. Think that what you are doing is using your house as a guarantee of payment. Before, if you did not pay the car loan, the bank could seize it. Now, if you don't pay the fee, they will go against your home.

Manage your investments well

Only what you have left over. "You should only invest the money you have left over and do it according to your risk profile," advises Almoguera. “You cannot take risks that you cannot take. Therefore, you should not invest in products that are not from your profile. It would be irresponsible for a person in retirement to invest in emerging funds or hedge funds. Well, the same for everyone ”, he warns

Juan Luis García-Alejo, Director of Analysis and Management of Inversis Banco.

You are also the Treasury. Do not let your money take it to the Treasury: only what is fair and the less, the better. No cheating, of course. “One of the most common nonsense we commit is poor fiscal management. We focus on the financial part and neglect the fiscal one. Then the Treasury arrives and claims its own ”, warns García-Alejo.

Fountain:

entrepreneurs.es

Above all, do not be in a hurry to look for easy money because they will surely cheat and extend the monthly commission to extend the duration, increasing interest in the same way.